B&O Tax Credit Program

Direct your tax dollars back into your community

Main Street Tax Credits are a way of ensuring your tax dollars are invested in your downtown community.

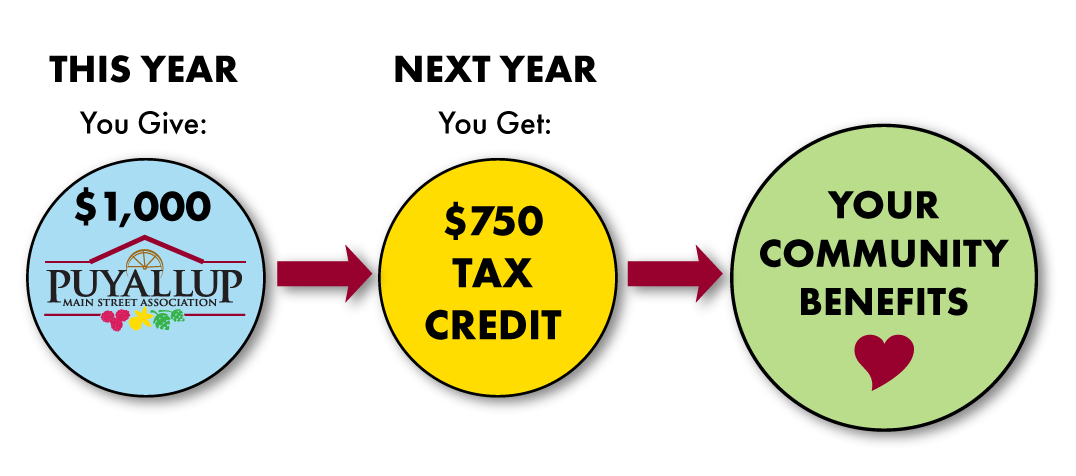

Make a pledge of as little as $1,000 to Puyallup Main Street Association beginning January 14, 2019, pay the pledge to PMSA by November 15th and 75% of your pledge will be deducted from your Washington Business and Occupation tax obligation.

For example: A pledge of $1,000 equals a tax credit of $750 in January of 2020. Because Puyallup Main Street Association is a 501 (c) 3 non-profit organizations, other tax incentives may apply. Check with your accountant for further details.

As you consider this request, if you have questions….or your colleagues have questions, please have them call the PMSA office at (253) 840-2631 or email us at director@puyallupmainstreet.com.

If you are ready to make your pledge follow these simple steps to enroll:

Step 1: Visit the WA Department of Revenue website and follow these step by step instructions to make a pledge:

Here are the step by step instructions:

- Starting January 14th, 2019, go to: https://secure.dor.wa.gov/home/

- Log in

- Click on “Get Started” link

- Click on your Excise Tax account

- Click “Credits” in the toolbar

- Click on “Add Main Street Application”

- Find Puyallup Main Street Association and enter the Contribution Amount; click next

- Fill out Authorization Information and click Submit.

- Click here for a screenshot with directions of how to apply!.

Step 2: Before November 15th, 2019 make a donation to PMSA . You can make the donation by sending a check to the following address:

Puyallup Main Street Association

PO Box 476

Puyallup, WA 98371

Step 3: In 2022, when you go to pay your B&O online, you will be given the amount of your credit in a drop-down menu and asked how much you would like to apply. It’s really that simple!

Thank you for your support of your Puyallup Main Street Association!